Charitable Bequest

Receive an estate tax charitable deduction

Reduce the burden of taxes on your family

Leave a lasting legacy to the Great Commission

How a bequest works

A bequest is one of the easiest gifts to make. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends or TCM as part of your estate plan, or you can make a bequest using a beneficiary designation form.

Here are some of the ways to leave a bequest to TCM

Include a bequest to TCM in your will or revocable trust.

DesignateTCM as a full, partial, or contingent beneficiary of your retirement account (IRA, 401(k), 403(b) or pension)

Name TCM as a beneficiary of your life insurance policy.

A bequest may be made in several ways

Percentage bequest - make a gift of a percentage of your estate

Specific bequest - make a gift of a specific dollar amount or a specific asset

Residual bequest - make a gift from the balance or residue of your estate Please Contact Us for any questions on leaving a Charitable Bequest

Beneficiary Designation Gifts

Support the causes that you care about

Continue to use your account as long as you need to

Simplify your planning and avoid expensive legal fees

Reduce the burden of taxes on your family

Receive an estate tax charitable deduction

How a beneficiary designation gift works

To make your gift, contact the person who helps you with your account or insurance policy, such as your broker, banker or insurance agent.

Ask them to send you a new beneficiary designation form.

Complete the form, sign it and mail it back to your broker, banker or agent.

When you pass away, your account or insurance policy will be paid or transferred to TCM, consistent with the beneficiary designation.

Important considerations for your future

If you are interested in making a gift but are also concerned about your future needs, keep in mind that beneficiary designation gifts are among the most flexible of all charitable gifts. Even after you complete the beneficiary designation form, you can take distributions or withdrawals from your retirement, investment or bank account and continue to freely use your account. You can also change your mind at any time for any reason, including if you have a loved one who needs your financial help. Contact us now by Clicking Here to set up a beneficiary designated gift!

Charitable Gift Annuity

A charitable gift annuity is a gift made to our organization that can provide you with a secure source of fixed payments for life.

Receive fixed payments to you or another annuitant you designate for life

Receive a charitable income tax deduction for the charitable gift portion of the annuity

Benefit from payments that may be partially tax-free

Further the kingdom impact of TCM with your gift

How a charitable gift annuity works

You transfer cash or property to TCM.

In exchange, we promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax-free.

You will receive a charitable income tax deduction for the gift portion of the annuity.

You also receive satisfaction, knowing that you will be helping further our mission.

If you decide to fund your gift annuity with cash, a significant portion of the annuity payment will be tax-free. You may also make a gift of appreciated securities to fund a gift annuity and avoid a portion of the capital gains tax. Please contact us to inquire about other assets that you might be able to use to fund a charitable gift annuity.

Charitable Remainder Unitrust

You may be concerned about the high cost of capital gains tax with the sale of an appreciated asset. Perhaps you recently sold property and are looking for a way to save on taxes this year and plan for retirement. A charitable remainder unitrust might offer the solutions you need!

Receive income for life, for a term of up to 20 years or life plus a term of up to 20 years

Avoid capital gains on the sale of your appreciated assets

Receive an immediate charitable income tax deduction for the charitable portion of the trust

Establish a future legacy gift to our organization

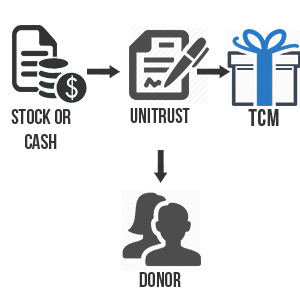

How a charitable remainder unitrust works

You transfer cash or assets to fund a charitable remainder unitrust.

In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

The trust is invested to pay income to you or any other trust beneficiaries you select based on a life, lives, a term of up to 20 years or a life plus a term of up to 20 years.

You receive an income tax deduction in the year you transfer assets to the trust.

Our organization benefits from what remains in the trust after all the trust payments have been made.

If you have more questions about a Charitable Remainder Unitrust or need guidance on exploring more options, Contact Us Here.

Charitable Remainder Annuity Trust

If you are tired of the fluctuating stock market and want to receive fixed payments, a charitable remainder annuity trust may provide you with the stability you desire. A charitable remainder annuity trust pays a fixed amount each year based on the value of the property at the time the trust is funded.

Receive fixed income for life or a term of up to 20 years

Avoid capital gains tax on the sale of your appreciated assets

Receive an immediate charitable income tax deduction for the charitable remainder portion of your gift to TCM.

How a charitable remainder annuity trust works

You transfer cash or assets to fund a charitable remainder annuity trust.

In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

The trust is invested to pay fixed income to you or any other trust beneficiaries you select based on a life, lives or a term of up to 20 years.

You receive an income tax deduction in the year you transfer assets to the trust.

Our organization benefits from what remains in the trust after all the trust payments have been made.

Click Here to contact us about setting up a charitable remainder annuity trust.

Charitable Lead Trust (for Family)

Pass inheritance on to family at a reduced or zero cost

Receive a gift or estate tax charitable deduction

Establish a vehicle from which you can make annual gifts to charity

How a charitable lead trust works

You make a contribution of your property to fund a trust that pays TCM income for a number of years.

You receive a gift or estate tax deduction at the time of your gift.

After a period of time, your family receives the trust assets plus any additional growth in value.

Interested in learning more? Click Here to contact us now.

Sale and Unitrust

If you sell your appreciated assets, such as stock, bonds or real estate, you will pay a large capital gains tax. A sale and charitable remainder unitrust may be the solution to avoid capital gains tax.

Receive cash from the sale. You can use this cash to purchase another residence, to save for retirement, to travel, to meet your daily needs, or to meet some other financial goal

Receive income from the unitrust for the rest of your life and future retirement

Obtain an income tax deduction that may reduce your tax bill this year

Further the work of TCM with your gift

How a sale and unitrust works

You establish a charitable remainder unitrust and transfer a portion of your assets to the trust.

The assets are then sold. You receive cash from the sale, and the rest of the sale's proceeds are paid to the charitable unitrust.

The trust will provide you with income for the rest of your life.

You receive a charitable deduction this year to offset your tax on the cash proceeds that you receive from the sale.

More on sale and unitrust

When transferring a portion of your primary residence to fund a unitrust, you may apply your one-time home exclusion to reduce or eliminate capital gains tax that would otherwise be due from the sale. Your tax advisor can assist you to determine if you should utilize this strategy. Click Here to contact us with any further questions.

Bargain Sale

Avoid capital gains tax on your charitable gift

Receive a tax deduction that will reduce your tax bill this year

Take the cash received from the sale and reinvest it to create future income, save for retirement, buy new property or achieve other financial goals

Help TCM further our important charitable work

How a bargain sale works

You sell TCM your property for a price less than fair market value.

You receive cash from the sale.

You can take a charitable deduction for the value of your gift which is the difference between the fair market value of the property less the sale price.

While you may owe some tax on the sale, proceeds you receive from TCM, the charitable deduction from your gift, could offset some, most, or all of your capital gains taxes associated with the sale.

To discuss your specific property situation, please contact us by Clicking Here.

Give It Twice Trust - Help Family and Charity

You may be looking for a way to provide your children with income while making a gift to TCM. The "give it twice" trust is a popular option that allows you to transfer your IRA or other asset at death to fund a term of years charitable remainder unitrust. We call this kind of unitrust a "give it twice" trust because you can use the trust to pay income first to your family for a number of years and then distribute the balance of the trust to charity.

Use the full value of your unused retirement account to provide income to your surviving spouse and to provide income to children or other loved ones for a specified period of time

Create an estate tax deduction and savings from the charitable gift

Support the important Kingdom work of TCM

How a give it twice trust works

We can help you and your attorney with the process of creating a charitable remainder unitrust.

You complete an IRA or other retirement account beneficiary designation form, naming the charitable trust as the beneficiary, and return the form to the account custodian.

When you pass away, the custodian will transfer your retirement account to the charitable trust.

The trust will pay income to your spouse, children or other individual beneficiaries for their life, term of years, or life plus term of years.

At the conclusion of the payments, the balance of the trust will be transferred to TCM.

If this giving avenue best fits your needs, Click Here to contact a representative who can assist you further.

Life Estate Reserved

Receive a federal income tax deduction for the value of the remainder interest in your home or farm

Preserve your lifetime use and control of your home or farm

Create a life estate based on more than one life. This will preserve the use of the property for you and a loved one, such as a spouse or dependent child

How a life estate works

You deed your home or farm to TCM. The deed will include a provision that gives you the right to use your home or farm for the rest of your life and that of any other life estate party named in the deed.

You and TCM sign a maintenance, insurance, and taxes (MIT) agreement to explain that you will do your best to keep the property in good condition and that you will maintain property insurance and pay the property taxes.

When the owners of the life estate have passed away, your home or farm will belong to TCM. We will use or sell the property to further our charitable work.

For questions or to discuss these unique planned giving options, please send me an email by filling out the boxes provided here. Or feel free to give me a call to speak over the phone.

317-299-0333

God Bless,